How Institutional Investors Are Approaching Cryptocurrencies

- Understanding the growing interest of institutional investors in cryptocurrencies

- Key factors influencing institutional investors’ decisions to enter the crypto market

- Challenges and opportunities for institutional investors in the volatile world of cryptocurrencies

- Strategies employed by institutional investors to mitigate risks in cryptocurrency investments

- Regulatory considerations shaping institutional investors’ approach to cryptocurrencies

- The future of institutional investment in cryptocurrencies: trends and predictions

Understanding the growing interest of institutional investors in cryptocurrencies

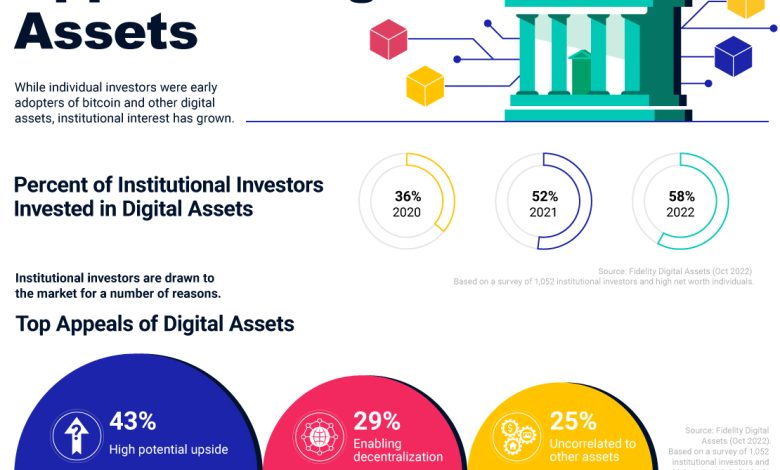

In recent years, there has been a noticeable surge in the interest of institutional investors in cryptocurrencies. This growing fascination can be attributed to several factors that have made digital assets more appealing to this particular group of investors. One of the main reasons for this increased interest is the potential for high returns that cryptocurrencies offer. Institutional investors are always on the lookout for opportunities to generate significant profits, and the volatile nature of the cryptocurrency market presents a unique chance for them to do so.

Moreover, the increasing acceptance and adoption of cryptocurrencies by mainstream financial institutions have also played a significant role in attracting institutional investors to this asset class. As more traditional financial institutions start to recognize the legitimacy and potential of cryptocurrencies, institutional investors are becoming more comfortable with the idea of including digital assets in their portfolios. This trend has been further fueled by the growing number of cryptocurrency exchanges and custodial services that cater specifically to institutional clients, providing them with the infrastructure and security they need to invest in cryptocurrencies confidently.

Another factor that has contributed to the growing interest of institutional investors in cryptocurrencies is the diversification benefits that digital assets can offer to their portfolios. Cryptocurrencies have a low correlation with traditional asset classes, which means that they can help reduce overall portfolio risk and increase returns through diversification. This has made cryptocurrencies an attractive option for institutional investors looking to hedge against market volatility and protect their portfolios from economic uncertainties.

Overall, the increasing interest of institutional investors in cryptocurrencies can be seen as a positive development for the digital asset market. As more institutional capital flows into cryptocurrencies, it is likely to bring greater stability, liquidity, and legitimacy to the market, making it more attractive to a broader range of investors. This trend is expected to continue in the coming years as cryptocurrencies become more mainstream and integrated into the global financial system.

Key factors influencing institutional investors’ decisions to enter the crypto market

There are several key factors that influence institutional investors’ decisions to enter the cryptocurrency market. These factors play a crucial role in shaping their strategies and risk management approaches when it comes to investing in digital assets.

- Regulatory Environment: Institutional investors closely monitor the regulatory landscape surrounding cryptocurrencies. Clarity and stability in regulations can provide them with a sense of security and confidence to enter the market.

- Market Maturity: The level of maturity in the cryptocurrency market is another important factor. Institutional investors are more likely to participate in a market that is well-established and has sufficient liquidity.

- Risk Management: Effective risk management practices are essential for institutional investors. They assess the risks associated with cryptocurrencies, such as volatility and security concerns, before making investment decisions.

- Market Infrastructure: The availability of robust market infrastructure, including reliable exchanges and custodial services, is crucial for institutional investors. They need to ensure that their investments are secure and easily accessible.

- Market Sentiment: Institutional investors also consider market sentiment and trends when evaluating the potential of cryptocurrencies. Positive sentiment can attract more institutional interest in the market.

Overall, institutional investors carefully evaluate these key factors before deciding to enter the cryptocurrency market. By considering these aspects, they can make informed decisions and navigate the complexities of the digital asset space effectively.

Challenges and opportunities for institutional investors in the volatile world of cryptocurrencies

As institutional investors navigate the volatile world of cryptocurrencies, they face a myriad of challenges and opportunities. One of the main challenges is the regulatory uncertainty surrounding digital assets. The lack of clear guidelines from governments and regulatory bodies can make it difficult for institutional investors to confidently enter the crypto market. However, this regulatory ambiguity also presents an opportunity for investors to potentially capitalize on the market before regulations are firmly in place.

Another challenge for institutional investors is the inherent volatility of cryptocurrencies. The prices of digital assets can fluctuate wildly in a short period, making it a risky investment. On the other hand, this volatility can also be seen as an opportunity for investors to make significant profits if they can accurately predict market trends and time their investments wisely.

Furthermore, the security risks associated with cryptocurrencies pose a challenge for institutional investors. Hacks and cyber attacks on crypto exchanges and wallets have resulted in significant losses for investors in the past. However, advancements in blockchain technology and security measures offer opportunities for investors to safeguard their assets and mitigate risks.

Strategies employed by institutional investors to mitigate risks in cryptocurrency investments

When it comes to investing in cryptocurrencies, institutional investors are well aware of the risks involved. To mitigate these risks, they employ various strategies to protect their investments and maximize returns. Some of the common strategies used by institutional investors include:

- Diversification: Institutional investors spread their investments across a range of cryptocurrencies to reduce the impact of volatility in any single asset.

- Due Diligence: Before investing in a cryptocurrency, institutional investors conduct thorough research to assess the potential risks and rewards associated with the investment.

- Risk Management: Institutional investors use risk management tools such as stop-loss orders and hedging strategies to protect their investments from sudden market fluctuations.

- Regulatory Compliance: Institutional investors ensure that their investments comply with relevant regulations to minimize legal risks.

- Long-Term Perspective: Instead of focusing on short-term gains, institutional investors take a long-term view of their cryptocurrency investments to ride out market volatility.

By employing these strategies, institutional investors can navigate the unpredictable world of cryptocurrencies with more confidence and reduce the potential risks associated with this emerging asset class.

Regulatory considerations shaping institutional investors’ approach to cryptocurrencies

Institutional investors are approaching cryptocurrencies with caution due to the regulatory considerations that shape their investment strategies. The evolving regulatory landscape surrounding cryptocurrencies has a significant impact on how institutional investors perceive and engage with this asset class.

One key factor influencing institutional investors’ approach to cryptocurrencies is the uncertainty surrounding regulatory frameworks. **Regulatory** bodies around the world are still grappling with how to classify and regulate cryptocurrencies, leading to a lack of clarity for investors. This ambiguity can deter institutional investors who prioritize regulatory compliance and risk management in their investment decisions.

Another regulatory consideration that institutional investors must take into account is the potential for regulatory changes. **Regulatory** authorities have the power to introduce new regulations or amend existing ones, which can have a profound impact on the value and legality of cryptocurrencies. Institutional investors must stay informed about regulatory developments and be prepared to adjust their investment strategies accordingly.

Additionally, institutional investors are mindful of the reputational risks associated with investing in cryptocurrencies in a regulatory gray area. **Regulatory** scrutiny and negative media coverage can harm the reputation of institutional investors, leading to potential backlash from clients, stakeholders, and regulators. As a result, many institutional investors are proceeding with caution when it comes to incorporating cryptocurrencies into their portfolios.

Overall, regulatory considerations play a crucial role in shaping institutional investors’ approach to cryptocurrencies. As the regulatory landscape continues to evolve, institutional investors must navigate these challenges carefully to ensure compliance, manage risks, and protect their reputations in the ever-changing world of cryptocurrencies.

The future of institutional investment in cryptocurrencies: trends and predictions

As institutional investors continue to explore the world of cryptocurrencies, there are several trends and predictions that are shaping the future of institutional investment in this space.

One trend that is becoming increasingly prevalent is the growing acceptance of cryptocurrencies as a legitimate asset class. More and more institutional investors are recognizing the potential for high returns that cryptocurrencies can offer, leading to a greater allocation of funds towards this emerging market.

Another trend to watch is the rise of cryptocurrency custodians. These specialized firms provide secure storage solutions for institutional investors looking to safeguard their digital assets. As the demand for custodial services grows, we can expect to see more players entering the market, offering a variety of solutions to meet the needs of different investors.

Looking ahead, one prediction is that regulatory clarity will play a crucial role in shaping the future of institutional investment in cryptocurrencies. As governments around the world work to establish clear guidelines for the use and trading of digital assets, institutional investors will have a better understanding of the risks and opportunities associated with this market.

Overall, the future of institutional investment in cryptocurrencies looks promising, with more investors recognizing the potential of this asset class and taking steps to incorporate it into their portfolios. By staying informed about the latest trends and developments in the cryptocurrency space, institutional investors can position themselves for success in this rapidly evolving market.