Tax Implications of Cryptocurrency Investments

- Understanding the tax treatment of cryptocurrency gains and losses

- Reporting requirements for cryptocurrency transactions to the IRS

- Tax implications of mining cryptocurrency

- Tax considerations when trading cryptocurrencies

- Tax consequences of using cryptocurrency for purchases

- Strategies for minimizing taxes on cryptocurrency investments

Understanding the tax treatment of cryptocurrency gains and losses

When it comes to understanding the tax treatment of cryptocurrency gains and losses, it is important to be aware of the implications that come with investing in this digital asset. The IRS considers cryptocurrency to be property rather than currency, which means that capital gains tax rules apply to transactions involving cryptocurrency.

When you sell or exchange your cryptocurrency for a profit, you will be subject to capital gains tax on the gains you have made. On the other hand, if you sell or exchange your cryptocurrency at a loss, you may be able to deduct that loss from your taxes.

It is important to keep accurate records of all your cryptocurrency transactions to ensure that you are compliant with tax laws. Failure to report your cryptocurrency gains could result in penalties or audits by the IRS. Consulting with a tax professional who is knowledgeable about cryptocurrency taxation can help you navigate the complexities of tax treatment for cryptocurrency investments.

Reporting requirements for cryptocurrency transactions to the IRS

When it comes to reporting requirements for cryptocurrency transactions to the IRS, it is essential for investors to understand their obligations. The IRS considers cryptocurrency as property for tax purposes, which means that transactions involving cryptocurrency are subject to tax reporting requirements.

One of the key reporting requirements for cryptocurrency transactions is the need to report capital gains and losses. This includes reporting any gains or losses realized from the sale or exchange of cryptocurrency. Failure to report these transactions can result in penalties and fines from the IRS.

Additionally, the IRS requires taxpayers to report any income earned through cryptocurrency mining or staking. This income is considered taxable and must be reported on tax returns. It is important for investors to keep detailed records of their mining or staking activities to accurately report this income to the IRS.

Furthermore, taxpayers who receive cryptocurrency as payment for goods or services must report the fair market value of the cryptocurrency as income. This income is also subject to taxation and must be reported on tax returns. Failure to report this income can result in penalties and fines.

In conclusion, understanding the reporting requirements for cryptocurrency transactions to the IRS is crucial for investors to avoid potential penalties and fines. By accurately reporting capital gains and losses, income from mining or staking, and income from payments received in cryptocurrency, investors can ensure compliance with tax laws and regulations.

Tax implications of mining cryptocurrency

When it comes to mining cryptocurrency, it is important to consider the tax implications that come along with it. The IRS treats mined cryptocurrency as income, which means it is subject to taxation. This means that miners are required to report the value of the cryptocurrency they mine as income on their tax returns.

Additionally, miners may also be subject to capital gains tax if they decide to sell the cryptocurrency they mine. The amount of tax owed will depend on how long the miner held the cryptocurrency before selling it. If the cryptocurrency is held for less than a year, it will be subject to short-term capital gains tax, which is typically higher than long-term capital gains tax.

It is important for miners to keep detailed records of their mining activities, including the value of the cryptocurrency mined and any expenses incurred during the mining process. This will help ensure that they are accurately reporting their income and expenses to the IRS.

Tax considerations when trading cryptocurrencies

When it comes to trading cryptocurrencies, it is important to consider the tax implications that come along with it. The IRS treats cryptocurrencies as property, meaning that any gains or losses from trading will be subject to capital gains tax. This tax is based on the difference between the purchase price and the selling price of the cryptocurrency.

It is crucial to keep detailed records of all cryptocurrency transactions, including the date of purchase, the amount spent, the date of sale, and the amount received. This information will be necessary when calculating capital gains or losses for tax purposes. Failure to report cryptocurrency transactions to the IRS can result in penalties and fines.

One strategy to minimize tax liability when trading cryptocurrencies is to utilize tax-loss harvesting. This involves selling losing investments to offset gains in other investments, thereby reducing the overall tax burden. Additionally, holding onto investments for more than a year can qualify for long-term capital gains tax rates, which are typically lower than short-term rates.

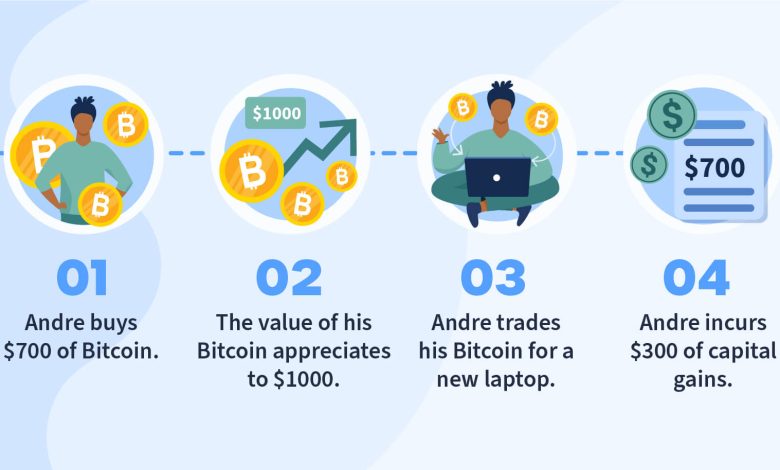

Tax consequences of using cryptocurrency for purchases

When using cryptocurrency for purchases, it is important to consider the tax consequences that may arise. The IRS treats cryptocurrency transactions as taxable events, meaning that they are subject to capital gains tax. This tax is calculated based on the difference between the purchase price of the cryptocurrency and the fair market value at the time of the transaction.

It is crucial to keep detailed records of all cryptocurrency transactions to accurately report them on your tax return. Failure to do so could result in penalties or audits by the IRS. Additionally, the tax rate for capital gains can vary depending on how long you held the cryptocurrency before using it for a purchase.

Some taxpayers may be tempted to avoid reporting their cryptocurrency transactions to the IRS due to the anonymous nature of cryptocurrencies. However, it is important to remember that the IRS has been cracking down on cryptocurrency tax evasion in recent years, so it is best to comply with tax laws to avoid any legal issues.

Strategies for minimizing taxes on cryptocurrency investments

When it comes to minimizing taxes on cryptocurrency investments, there are several strategies that investors can employ to reduce their tax liability. By being proactive and strategic in their approach, investors can potentially save a significant amount of money in taxes. Here are some effective strategies to consider:

- Hold for Long-Term: One of the most common strategies to minimize taxes on cryptocurrency investments is to hold onto your assets for the long term. By holding onto your investments for more than a year, you may qualify for lower long-term capital gains tax rates.

- Offset Gains with Losses: Another strategy is to offset gains with losses. If you have investments that have decreased in value, you can sell them to offset any gains you have realized from your cryptocurrency investments.

- Utilize Tax-Advantaged Accounts: Investing in cryptocurrency through tax-advantaged accounts such as IRAs or 401(k)s can help minimize taxes on your investments. These accounts offer tax benefits that can help you save money in the long run.

- Stay Updated on Tax Laws: It is crucial to stay informed about the latest tax laws and regulations surrounding cryptocurrency investments. By staying updated, you can take advantage of any tax breaks or incentives that may be available to you.

- Consider Tax-Loss Harvesting: Tax-loss harvesting involves selling investments at a loss to offset gains and reduce your tax liability. This strategy can be particularly useful in volatile cryptocurrency markets.

By implementing these strategies and staying informed about tax implications, investors can effectively minimize taxes on their cryptocurrency investments and maximize their overall returns.