Price Analysis: Bitcoin’s Volatility and Market Trends

- Understanding Bitcoin’s Price Volatility

- The Impact of Market Trends on Bitcoin’s Value

- Analyzing the Fluctuations in Bitcoin’s Price

- Strategies for Navigating Bitcoin’s Volatile Market

- The Role of Speculation in Bitcoin’s Price

- Comparing Bitcoin’s Price Trends to Other Cryptocurrencies

Understanding Bitcoin’s Price Volatility

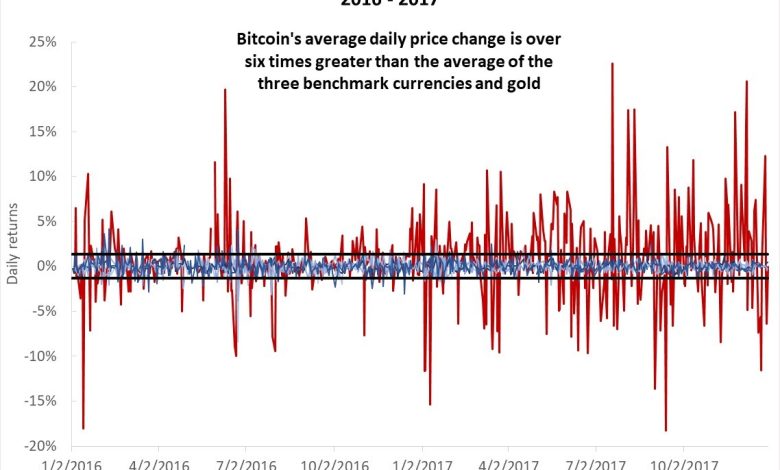

Bitcoin’s price volatility is a well-known characteristic of the cryptocurrency market. The value of Bitcoin can fluctuate significantly within a short period, leading to both opportunities and risks for investors. Understanding the factors that contribute to Bitcoin’s price volatility is crucial for making informed decisions in the market.

One of the main drivers of Bitcoin’s price volatility is market demand. When there is high demand for Bitcoin, its price tends to increase rapidly. Conversely, when demand decreases, the price can drop just as quickly. This demand is influenced by various factors such as market sentiment, regulatory developments, and macroeconomic trends.

Another factor that affects Bitcoin’s price volatility is market liquidity. A lack of liquidity in the market can lead to sharp price movements, as even small buy or sell orders can have a significant impact on the price of Bitcoin. This lack of liquidity can be exacerbated during times of market uncertainty or when there is a sudden influx of trading activity.

Additionally, external events such as geopolitical tensions, regulatory announcements, or technological developments can also contribute to Bitcoin’s price volatility. These events can create uncertainty in the market, causing traders to react quickly and leading to sharp price fluctuations. Traders need to stay informed about these external factors to anticipate potential price movements and manage their risk effectively.

Overall, Bitcoin’s price volatility is a natural aspect of the cryptocurrency market. While it can present opportunities for traders to profit from price swings, it also carries risks for those who are not prepared. By understanding the factors that drive Bitcoin’s price volatility and staying informed about market trends, traders can navigate the market more effectively and make informed decisions about their investments.

The Impact of Market Trends on Bitcoin’s Value

Market trends play a significant role in determining the value of Bitcoin. The cryptocurrency market is highly volatile, with prices fluctuating based on various factors such as supply and demand, investor sentiment, regulatory developments, and macroeconomic trends. Understanding these market trends is crucial for investors looking to make informed decisions about buying or selling Bitcoin.

One of the key market trends that impact Bitcoin’s value is the overall sentiment towards cryptocurrencies. Positive news such as institutional adoption, regulatory clarity, or technological advancements can drive up the price of Bitcoin, while negative news like security breaches, regulatory crackdowns, or market manipulation can lead to a decrease in value. Keeping an eye on the news and staying informed about the latest developments in the cryptocurrency space can help investors anticipate market movements and make better trading decisions.

Another important market trend to consider is the level of demand for Bitcoin. As more people and institutions show interest in investing in Bitcoin, the demand for the cryptocurrency increases, driving up its price. Factors such as growing acceptance of Bitcoin as a store of value, increasing use cases for the cryptocurrency, and inflation hedging properties can all contribute to rising demand and higher prices. On the other hand, a decrease in demand can lead to a drop in Bitcoin’s value.

Additionally, macroeconomic trends such as inflation, interest rates, and geopolitical events can also influence the value of Bitcoin. In times of economic uncertainty or currency devaluation, investors may turn to Bitcoin as a safe haven asset, leading to an increase in demand and price. Understanding how these macroeconomic factors interact with the cryptocurrency market can provide valuable insights into Bitcoin’s price movements and help investors navigate volatile market conditions.

Analyzing the Fluctuations in Bitcoin’s Price

Bitcoin’s price has been known for its high volatility, with frequent fluctuations in value. These fluctuations can be attributed to various factors such as market demand, regulatory news, and macroeconomic trends. Analyzing the fluctuations in Bitcoin’s price can provide valuable insights into market trends and potential investment opportunities.

One way to analyze Bitcoin’s price fluctuations is to look at historical price data and identify patterns or trends. By examining price charts and technical indicators, analysts can gain a better understanding of how Bitcoin’s price has moved in the past and make informed predictions about future price movements.

Another method of analyzing Bitcoin’s price fluctuations is to consider external factors that may impact the cryptocurrency market. For example, regulatory developments, such as government crackdowns on cryptocurrency exchanges, can have a significant impact on Bitcoin’s price. Similarly, macroeconomic trends, such as inflation or economic uncertainty, can also influence the value of Bitcoin.

Overall, analyzing the fluctuations in Bitcoin’s price is essential for investors looking to make informed decisions about buying or selling the cryptocurrency. By understanding the factors that drive price movements and staying informed about market trends, investors can better navigate the volatile world of Bitcoin trading.

Strategies for Navigating Bitcoin’s Volatile Market

When dealing with the volatile market of Bitcoin, it is crucial to have a solid strategy in place to navigate the ups and downs effectively. Here are some strategies to help you manage the price fluctuations:

- Diversify your investment portfolio to spread out risk and minimize potential losses.

- Set clear profit targets and stop-loss orders to lock in gains and limit losses.

- Stay informed about market trends and news that could impact the price of Bitcoin.

- Avoid making impulsive decisions based on emotions or short-term price movements.

- Consider using technical analysis tools to identify patterns and trends in the market.

By following these strategies, you can better navigate the volatile market of Bitcoin and make more informed investment decisions.

The Role of Speculation in Bitcoin’s Price

Speculation plays a significant role in determining the price of Bitcoin. Traders and investors often engage in speculative activities, trying to predict the future price movements of the cryptocurrency. This speculation can lead to rapid price fluctuations, as market participants buy and sell based on their expectations of where the price will go next.

One of the main drivers of speculation in Bitcoin’s price is the limited supply of the cryptocurrency. With only 21 million Bitcoins ever to be mined, scarcity plays a crucial role in determining its value. As demand for Bitcoin increases, driven by factors such as institutional adoption and macroeconomic uncertainty, speculators may anticipate higher prices in the future and buy in accordingly.

Moreover, the decentralized nature of Bitcoin and its lack of regulation make it particularly susceptible to speculation. Without a central authority controlling its supply or value, the market is left to determine the price of Bitcoin based on supply and demand dynamics. This lack of oversight can lead to increased volatility, as speculative trading can drive prices up or down rapidly.

Comparing Bitcoin’s Price Trends to Other Cryptocurrencies

When comparing Bitcoin’s price trends to other cryptocurrencies, it is important to consider the overall market dynamics. While Bitcoin remains the dominant player in the cryptocurrency space, there are other digital assets that have shown significant price movements in recent years.

One way to analyze the price trends of different cryptocurrencies is to look at their historical performance. By examining past price data, investors can gain insights into how Bitcoin compares to other digital assets in terms of volatility and market trends.

It is also important to consider the factors that influence the price of Bitcoin and other cryptocurrencies. Market sentiment, regulatory developments, and technological advancements can all impact the price movements of digital assets.

Overall, while Bitcoin remains the most widely traded and recognized cryptocurrency, there are other digital assets that have shown promising price trends. By analyzing the price movements of different cryptocurrencies, investors can make more informed decisions about their investment strategies in the cryptocurrency market.