Daily Digest: Updates on Global Cryptocurrency Adoption

- The Rise of Cryptocurrency: A Global Perspective

- Key Factors Driving Cryptocurrency Adoption Worldwide

- Cryptocurrency Regulations Around the World: What You Need to Know

- Case Studies: Countries Embracing Cryptocurrency in Their Economies

- Challenges and Opportunities in the Global Cryptocurrency Market

- The Future of Money: How Cryptocurrency is Reshaping the Financial Landscape

The Rise of Cryptocurrency: A Global Perspective

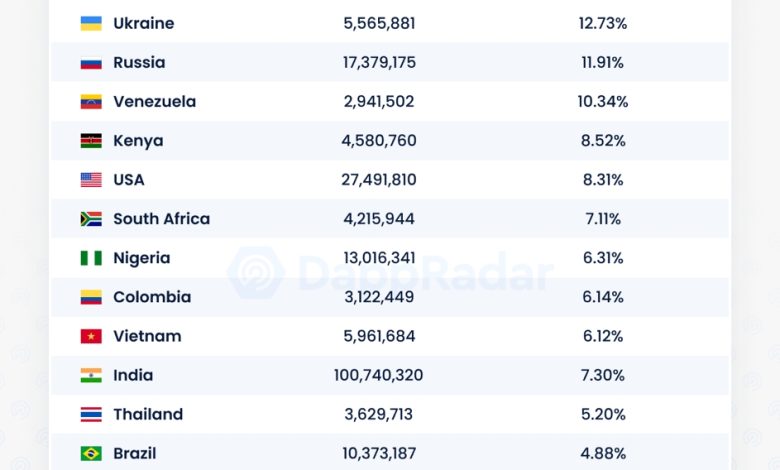

The rise of cryptocurrency has been a global phenomenon, with countries around the world embracing this new form of digital currency. From the United States to Japan, from Europe to Africa, cryptocurrency adoption is on the rise. This global perspective highlights the growing acceptance and integration of cryptocurrencies into mainstream financial systems.

Key Factors Driving Cryptocurrency Adoption Worldwide

There are several key factors driving the adoption of cryptocurrency worldwide. One of the main reasons is the increasing awareness and understanding of blockchain technology, which is the foundation of cryptocurrencies. People are becoming more familiar with the benefits of decentralized systems and the security they provide.

Another factor is the growing acceptance of cryptocurrencies by businesses and financial institutions. More and more companies are starting to accept digital currencies as a form of payment, and some are even investing in blockchain technology to streamline their operations.

Regulatory changes are also playing a significant role in the adoption of cryptocurrencies. As governments around the world start to create clearer guidelines for the use of digital assets, investors and consumers are gaining more confidence in the market.

Moreover, the increasing popularity of peer-to-peer transactions and the rise of decentralized finance (DeFi) platforms are driving more people to explore the world of cryptocurrencies. These platforms offer users the opportunity to earn interest on their digital assets and access a wide range of financial services without the need for traditional banks.

Overall, the combination of technological advancements, institutional acceptance, regulatory clarity, and the rise of DeFi is creating a perfect storm for the widespread adoption of cryptocurrencies on a global scale.

Cryptocurrency Regulations Around the World: What You Need to Know

When it comes to cryptocurrency regulations around the world, it’s important to stay informed on the latest updates. Different countries have varying approaches to regulating digital currencies, which can impact how they are used and traded. Here are some key points to keep in mind:

- United States: The US has a complex regulatory environment for cryptocurrencies, with different agencies overseeing various aspects of the industry. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are two of the main regulatory bodies.

- European Union: The EU has taken a more unified approach to cryptocurrency regulation, with the European Commission proposing a comprehensive framework to regulate digital assets. This includes measures to combat money laundering and terrorist financing.

- China: China has taken a strict stance on cryptocurrencies, banning initial coin offerings (ICOs) and cracking down on crypto mining operations. The country has also been exploring the development of its own digital currency.

- Japan: Japan has been more welcoming of cryptocurrencies, with the government officially recognizing Bitcoin as a legal form of payment. The country has also implemented licensing requirements for cryptocurrency exchanges to ensure consumer protection.

It’s important for anyone involved in the cryptocurrency space to be aware of the regulations in their country and how they may impact their activities. Staying informed and compliant with the law is crucial for the long-term success and sustainability of the industry.

Case Studies: Countries Embracing Cryptocurrency in Their Economies

Several countries around the world are increasingly embracing cryptocurrency in their economies, recognizing the potential benefits it can bring. Let’s take a look at some case studies of countries that have taken steps to integrate cryptocurrency into their financial systems:

- Japan: Japan has been at the forefront of cryptocurrency adoption, recognizing it as a legal form of payment since 2017. The country has implemented regulations to protect consumers while fostering innovation in the cryptocurrency space.

- Switzerland: Switzerland has established itself as a cryptocurrency-friendly nation, with the city of Zug becoming known as “Crypto Valley.” The country has created a supportive regulatory environment for cryptocurrency startups and businesses.

- South Korea: South Korea has seen a surge in cryptocurrency adoption, with a high percentage of the population actively trading and investing in digital assets. The government has taken steps to regulate the cryptocurrency market while supporting blockchain technology development.

- Malta: Malta has positioned itself as a cryptocurrency hub in Europe, attracting cryptocurrency exchanges and blockchain companies with its favorable regulatory framework. The country has been proactive in creating a welcoming environment for cryptocurrency businesses.

These case studies demonstrate how countries are embracing cryptocurrency as a means to drive economic growth and innovation. By adopting cryptocurrency into their economies, these nations are positioning themselves at the forefront of the digital revolution, paving the way for a more inclusive and efficient financial system.

Challenges and Opportunities in the Global Cryptocurrency Market

The global cryptocurrency market presents a myriad of challenges and opportunities for investors and businesses alike. One of the main challenges is the regulatory uncertainty surrounding cryptocurrencies in many countries. Governments are still grappling with how to classify and regulate these digital assets, which can create uncertainty and volatility in the market.

On the other hand, the global cryptocurrency market also offers numerous opportunities for growth and innovation. As more people and businesses adopt cryptocurrencies, there is a growing demand for services and products that cater to this new form of digital currency. This has led to the rise of new industries and job opportunities in the cryptocurrency space.

Additionally, the global nature of cryptocurrencies means that they can provide a borderless and decentralized way to transfer value across the world. This has the potential to revolutionize the way we think about finance and commerce, opening up new possibilities for global trade and financial inclusion.

The Future of Money: How Cryptocurrency is Reshaping the Financial Landscape

The future of money is being reshaped by the rise of cryptocurrency, which is revolutionizing the financial landscape. Cryptocurrency is a digital form of currency that uses cryptography for security and operates independently of a central authority. This decentralized nature of cryptocurrency makes it immune to government interference and manipulation, providing users with greater financial freedom and privacy.

One of the key advantages of cryptocurrency is its ability to facilitate fast and low-cost cross-border transactions. Traditional banking systems often involve high fees and long processing times for international transfers, but cryptocurrency transactions can be completed in a matter of minutes with minimal fees. This has the potential to greatly improve financial inclusion and accessibility for people around the world.

Furthermore, the blockchain technology that underpins cryptocurrency offers a transparent and secure way to record transactions. Each transaction is recorded on a public ledger that is immutable and tamper-proof, providing a high level of security and trust. This has the potential to revolutionize industries beyond finance, such as supply chain management and voting systems.

As cryptocurrency adoption continues to grow globally, it is important for individuals and businesses to stay informed about this rapidly evolving technology. By understanding the benefits and risks of cryptocurrency, people can make informed decisions about how to incorporate it into their financial strategies. The future of money is here, and cryptocurrency is leading the way towards a more decentralized and efficient financial system.