Fundamental Analysis of Top Altcoins: Which Are Undervalued?

- Understanding the basics of fundamental analysis in cryptocurrency

- Key factors to consider when evaluating the value of altcoins

- Comparing the market cap and potential growth of top altcoins

- Identifying undervalued altcoins with strong fundamentals

- Analyzing the team, technology, and community behind popular altcoins

- Tips for investors looking to capitalize on undervalued altcoin opportunities

Understanding the basics of fundamental analysis in cryptocurrency

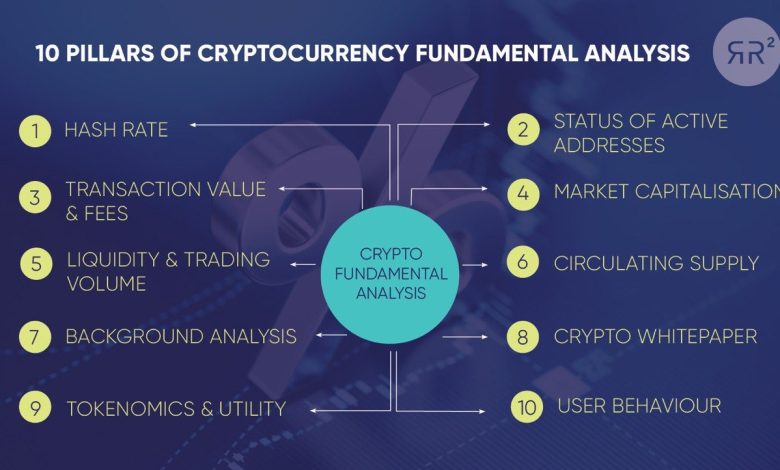

Fundamental analysis is a crucial aspect of evaluating the value of cryptocurrencies. It involves assessing the underlying factors that could affect the price of a particular altcoin. By understanding the basics of fundamental analysis, investors can make more informed decisions about which altcoins are undervalued and have the potential for growth.

One key component of fundamental analysis is examining the technology behind a cryptocurrency. This includes looking at the blockchain technology it is built on, the scalability of the network, and any unique features that set it apart from other cryptocurrencies. By evaluating these technical aspects, investors can determine the long-term viability of a particular altcoin.

Another important factor to consider in fundamental analysis is the team behind the cryptocurrency. A strong and experienced team can greatly impact the success of a project. Investors should research the backgrounds of the developers, advisors, and other team members to assess their credibility and expertise.

Market trends and adoption rates are also essential considerations in fundamental analysis. By analyzing how widely a cryptocurrency is used and accepted, investors can gauge its potential for mainstream adoption. Additionally, keeping an eye on market trends and regulatory developments can help investors anticipate future price movements.

Overall, fundamental analysis provides a comprehensive view of a cryptocurrency’s value and potential for growth. By taking into account the technology, team, market trends, and adoption rates, investors can make more informed decisions about which altcoins are undervalued and worth investing in.

Key factors to consider when evaluating the value of altcoins

When evaluating the value of altcoins, there are several key factors to consider that can help determine which ones are undervalued and have the potential for growth. These factors include:

– **Market Capitalization**: Market capitalization is a key indicator of an altcoin’s value. It is calculated by multiplying the current price of the coin by the total number of coins in circulation. Altcoins with a lower market capitalization may have more room for growth compared to those with a higher market cap.

– **Technology and Use Case**: The technology behind an altcoin and its real-world use case are important factors to consider. Altcoins that offer innovative technology solutions or serve a specific purpose are more likely to have long-term value and potential for growth.

– **Development Team**: The development team behind an altcoin plays a crucial role in its success. A strong and experienced team with a proven track record can instill confidence in investors and contribute to the value of the altcoin.

– **Community Support**: The level of community support and engagement around an altcoin can also impact its value. A strong and active community can help drive adoption and increase demand for the altcoin.

– **Market Demand**: Understanding the market demand for an altcoin is essential when evaluating its value. Altcoins that solve a pressing issue or have a unique value proposition are more likely to attract investors and increase in value over time.

By considering these key factors when evaluating the value of altcoins, investors can make more informed decisions and identify which altcoins are undervalued and have the potential for growth in the future.

Comparing the market cap and potential growth of top altcoins

When comparing the market capitalization and potential growth of top altcoins, it is essential to consider various factors that can influence their value and future performance. Market capitalization is a key metric that reflects the total value of a cryptocurrency in circulation, calculated by multiplying the current price by the total number of coins in circulation. However, market cap alone does not provide a complete picture of a coin’s potential for growth.

Investors should also analyze the potential growth prospects of altcoins based on factors such as technology innovation, adoption rate, development team, and market demand. Some altcoins may have a lower market cap but possess strong fundamentals that could drive future growth and increase their value over time.

It is crucial to conduct a thorough fundamental analysis of altcoins to identify undervalued assets with the potential for significant growth in the future. By evaluating both market cap and growth potential, investors can make informed decisions and capitalize on opportunities in the dynamic cryptocurrency market.

Identifying undervalued altcoins with strong fundamentals

When it comes to identifying **undervalued altcoins** with **strong fundamentals**, investors need to conduct a thorough **fundamental analysis**. This involves looking at various factors such as the **project team**, **technology**, **market potential**, and **community support**. By evaluating these aspects, investors can determine which **altcoins** have the potential for long-term growth and are currently **undervalued** in the market.

One key aspect to consider when evaluating **altcoins** is the **project team** behind the **cryptocurrency**. A strong and experienced team can greatly increase the chances of success for a **project**. Investors should look for **teams** with a proven track record in the **blockchain** and **cryptocurrency** space, as well as a clear **roadmap** for **development**.

Another important factor to consider is the **technology** that powers the **altcoin**. **Investors** should look for **projects** that are utilizing **innovative** and **scalable** **technology** that solves real-world problems. **Altcoins** with unique **features** and **use cases** are more likely to gain **adoption** and **value** over time.

Additionally, **market potential** is a crucial aspect to consider when evaluating **undervalued altcoins**. **Investors** should look for **projects** that are targeting **large** and **growing** **markets**, as this can lead to **increased demand** for the **cryptocurrency**. **Altcoins** that have a clear **value proposition** and **target audience** are more likely to succeed in the long run.

Lastly, **community support** is an important factor to consider when evaluating **undervalued altcoins**. **Projects** with a **strong** and **active** **community** are more likely to gain **traction** and **adoption** in the **market**. **Investors** should look for **altcoins** that have a **dedicated** and **engaged** **community** that is supportive of the **project**.

Analyzing the team, technology, and community behind popular altcoins

When analyzing the team, technology, and community behind popular altcoins, it is essential to consider various factors that can impact their value and potential for growth. The team behind an altcoin plays a crucial role in its success, as their expertise and experience can determine the project’s direction and execution. It is important to research the backgrounds of the team members, their previous projects, and their level of involvement in the altcoin’s development.

Furthermore, the technology powering an altcoin is another key aspect to evaluate. The underlying technology should be innovative, secure, and scalable to ensure the altcoin’s longevity and relevance in the ever-evolving cryptocurrency market. Conducting a thorough technical analysis of the altcoin’s blockchain, consensus mechanism, and smart contract capabilities can provide valuable insights into its potential for adoption and growth.

Lastly, the community surrounding an altcoin can significantly impact its success. A strong and engaged community can drive adoption, increase liquidity, and generate positive sentiment around the altcoin. Monitoring social media channels, forums, and developer communities can help gauge the level of interest and support for the altcoin among investors and users.

Tips for investors looking to capitalize on undervalued altcoin opportunities

Investors seeking to take advantage of **undervalued** altcoin opportunities should consider conducting thorough **fundamental analysis** before making any investment decisions. Here are some **tips** to help you identify **undervalued** altcoins and potentially capitalize on them:

- Look for altcoins with strong **fundamentals** such as a solid **development** team, a clear **use case**, and a **growing** community. These factors can indicate the long-term **viability** of the **project**.

- Consider the **market** **cap** of the altcoin in relation to its **competitors**. A low **market** **cap** relative to similar **projects** could suggest that the altcoin is **undervalued**.

- Examine the **technology** behind the altcoin and assess whether it offers any **unique** features or **advantages** compared to other **cryptocurrencies**. **Innovative** **technology** can set an altcoin apart and attract **investors**.

- Monitor **social** **media** **sentiment** and **community** **engagement** around the altcoin. **Positive** **sentiment** and a **growing** **community** could indicate **increased** **interest** in the altcoin.

- Keep an eye on **market** trends and **news** that could impact the **price** of the altcoin. **Staying** informed about **developments** in the **cryptocurrency** **space** can help you make **informed** **investment** decisions.

By following these **tips** and conducting **thorough** **research**, **investors** may be able to identify **undervalued** altcoins with **growth** potential and **capitalize** on **investment** opportunities in the **cryptocurrency** **market**.