Analyzing the Role of Central Banks in Crypto Regulation

- Understanding the impact of central banks on crypto regulation

- Exploring the evolving relationship between central banks and cryptocurrencies

- The role of central banks in shaping the regulatory landscape for digital assets

- Challenges and opportunities for central banks in regulating the crypto market

- A closer look at how central banks are adapting to the rise of cryptocurrencies

- The future of crypto regulation: central banks’ perspectives and strategies

Understanding the impact of central banks on crypto regulation

Central banks play a crucial role in shaping the regulatory landscape for cryptocurrencies. Their decisions and policies have a significant impact on how digital assets are perceived and treated within the financial system. Understanding the influence of central banks on crypto regulation is essential for anyone involved in the crypto space.

Central banks are responsible for overseeing monetary policy and financial stability within their respective countries. As such, they have a vested interest in ensuring that cryptocurrencies do not pose a threat to the traditional financial system. Central banks often view cryptocurrencies with caution due to their decentralized nature and potential for anonymity, which can make them attractive for illicit activities.

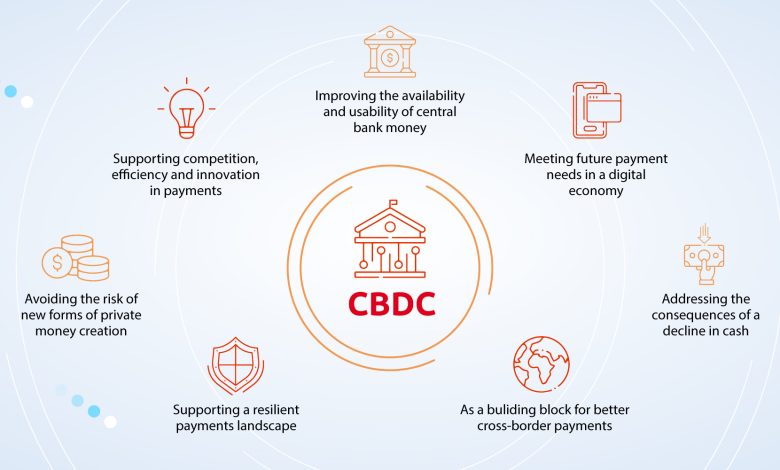

Central banks have taken various approaches to regulating cryptocurrencies. Some have embraced digital assets and are working on developing their own central bank digital currencies (CBDCs). Others have taken a more cautious approach, imposing restrictions on the use of cryptocurrencies or outright banning them. The regulatory stance of central banks can have a significant impact on the adoption and growth of cryptocurrencies within their jurisdictions.

It is essential for stakeholders in the crypto industry to closely monitor the actions and statements of central banks regarding cryptocurrencies. By understanding the motivations and concerns of central banks, stakeholders can better navigate the regulatory environment and ensure compliance with relevant laws and regulations. Central banks will continue to play a key role in shaping the future of crypto regulation, making it crucial to stay informed and engaged with their evolving policies.

Exploring the evolving relationship between central banks and cryptocurrencies

Central banks around the world are closely monitoring the rise of cryptocurrencies and their impact on the traditional financial system. The relationship between central banks and cryptocurrencies is constantly evolving as regulators grapple with how to regulate this new form of digital currency.

Central banks have expressed concerns about the potential risks that cryptocurrencies pose to financial stability, including money laundering, terrorist financing, and consumer protection. As a result, many central banks are exploring ways to regulate cryptocurrencies to mitigate these risks while still allowing for innovation in the financial sector.

Some central banks have taken a proactive approach to cryptocurrencies by exploring the possibility of issuing their own digital currencies, known as central bank digital currencies (CBDCs). These CBDCs would be issued and regulated by central banks, providing a secure and stable alternative to existing cryptocurrencies.

Overall, the relationship between central banks and cryptocurrencies is complex and multifaceted. Central banks are grappling with how to regulate cryptocurrencies while still fostering innovation in the financial sector. As the cryptocurrency market continues to evolve, central banks will play a crucial role in shaping the future of digital currencies.

The role of central banks in shaping the regulatory landscape for digital assets

Central banks play a crucial role in shaping the regulatory landscape for digital assets. As the primary authority responsible for monetary policy and financial stability, central banks have a significant influence on how cryptocurrencies and other digital assets are regulated.

One of the key ways central banks impact the regulatory environment for digital assets is through the issuance of guidelines and regulations. These guidelines help establish the rules and standards that govern the use and trading of cryptocurrencies. By setting clear guidelines, central banks can help reduce uncertainty and promote trust in the digital asset market.

Central banks also work closely with other regulatory bodies to coordinate efforts in regulating digital assets. This collaboration ensures that regulations are consistent and effective in addressing the unique challenges posed by cryptocurrencies. By working together, central banks and other regulators can create a more cohesive regulatory framework that protects investors and maintains financial stability.

Furthermore, central banks have the authority to monitor and supervise financial institutions that are involved in the trading or custody of digital assets. By overseeing these institutions, central banks can help mitigate risks and prevent illicit activities such as money laundering and terrorist financing. This oversight is essential in ensuring the integrity of the financial system.

In conclusion, central banks play a critical role in shaping the regulatory landscape for digital assets. Through the issuance of guidelines, collaboration with other regulators, and supervision of financial institutions, central banks help create a regulatory environment that promotes transparency, stability, and trust in the digital asset market.

Challenges and opportunities for central banks in regulating the crypto market

Central banks face a myriad of challenges and opportunities when it comes to regulating the crypto market. One of the main challenges is the decentralized nature of cryptocurrencies, which makes it difficult for traditional regulatory bodies to monitor and control. However, this also presents an opportunity for central banks to adapt and innovate their regulatory frameworks to better suit the digital landscape.

Another challenge is the lack of international coordination on crypto regulation, as different countries have varying approaches to overseeing the market. Central banks can use this as an opportunity to collaborate with other regulatory bodies globally to create a more cohesive and effective regulatory environment for cryptocurrencies.

Furthermore, the rapid pace of technological advancements in the crypto space poses a challenge for central banks to keep up with the evolving market. However, this also provides an opportunity for central banks to leverage technology to enhance their regulatory capabilities and stay ahead of the curve.

In conclusion, while regulating the crypto market presents central banks with numerous challenges, it also offers them the opportunity to modernize their regulatory frameworks, collaborate internationally, and leverage technology to effectively oversee this emerging asset class.

A closer look at how central banks are adapting to the rise of cryptocurrencies

Central banks around the world are closely monitoring the rapid growth of cryptocurrencies and are adapting their strategies to address the challenges posed by this new form of digital currency. As the popularity of cryptocurrencies continues to rise, central banks are exploring ways to regulate and integrate them into the existing financial system.

One of the key concerns for central banks is the potential impact of cryptocurrencies on monetary policy and financial stability. Central banks are studying the implications of cryptocurrencies on inflation, interest rates, and the overall economy. They are also considering the risks associated with cryptocurrencies, such as money laundering, terrorist financing, and consumer protection.

To address these challenges, central banks are exploring various regulatory approaches to cryptocurrencies. Some central banks are considering issuing their own digital currencies, known as central bank digital currencies (CBDCs), to compete with existing cryptocurrencies. Others are focusing on regulating and supervising cryptocurrency exchanges and trading platforms to ensure compliance with anti-money laundering and know-your-customer regulations.

Overall, central banks are taking a cautious approach to cryptocurrencies, balancing the potential benefits of innovation with the need to maintain financial stability and protect consumers. As the cryptocurrency landscape continues to evolve, central banks will play a crucial role in shaping the future of digital finance.

The future of crypto regulation: central banks’ perspectives and strategies

Central banks around the world are closely monitoring the rise of cryptocurrencies and the impact they have on the traditional financial system. As digital assets continue to gain popularity, central banks are exploring ways to regulate this new form of currency to ensure financial stability and protect consumers.

One of the key strategies central banks are considering is the development of their own digital currencies, known as central bank digital currencies (CBDCs). By issuing CBDCs, central banks aim to provide a secure and reliable alternative to existing cryptocurrencies, while maintaining control over the monetary system.

Another approach central banks are taking is to work with other regulatory bodies to establish clear guidelines for the use of cryptocurrencies. This includes implementing anti-money laundering (AML) and know your customer (KYC) regulations to prevent illicit activities and protect investors.

Overall, central banks are taking a cautious approach to crypto regulation, balancing the need to foster innovation with the responsibility to safeguard the financial system. By collaborating with other stakeholders and leveraging their expertise in monetary policy, central banks are working towards a regulatory framework that promotes the growth of cryptocurrencies while mitigating potential risks.