Deep Dive into Trading Volume Patterns in Crypto Markets

- Understanding the importance of trading volume in crypto markets

- Analyzing the relationship between trading volume and price movements

- Identifying common trading volume patterns in cryptocurrency trading

- Exploring the impact of trading volume on market liquidity

- Strategies for interpreting and utilizing trading volume data effectively

- Case studies of successful trading based on volume patterns in crypto markets

Understanding the importance of trading volume in crypto markets

Understanding the significance of trading volume in cryptocurrency markets is crucial for investors and traders alike. Trading volume refers to the total number of assets that are traded within a specific period, typically 24 hours in the crypto market. It is an essential metric that provides insights into the level of market activity and liquidity.

High trading volume indicates a high level of interest and participation in a particular cryptocurrency, which can lead to increased price volatility. On the other hand, low trading volume may indicate a lack of interest or confidence in a cryptocurrency, making it less liquid and potentially more susceptible to price manipulation.

Monitoring trading volume patterns can help traders identify potential trends and make informed decisions about buying or selling assets. For example, a sudden increase in trading volume accompanied by a price spike could signal a bullish trend, while a decrease in volume might indicate a bearish trend.

Additionally, analyzing trading volume can help traders assess the overall health of a cryptocurrency market. Consistently high trading volume is generally seen as a positive sign of market stability and investor confidence, while erratic or declining volume could be a red flag for potential market manipulation or lack of interest.

In conclusion, trading volume plays a significant role in determining the dynamics of cryptocurrency markets. By understanding and analyzing volume patterns, traders can gain valuable insights that can help them navigate the volatile and ever-changing crypto landscape more effectively.

Analyzing the relationship between trading volume and price movements

When analyzing the relationship between trading volume and price movements in crypto markets, it is essential to consider the impact that trading activity can have on the overall market dynamics. Trading volume refers to the total number of shares or contracts traded in a security or market during a given period. It is a crucial indicator of market liquidity and can provide valuable insights into the strength and direction of price movements.

High trading volume typically indicates increased market participation and interest in a particular asset. This can lead to greater price volatility as more buyers and sellers enter the market, resulting in larger price swings. On the other hand, low trading volume may suggest a lack of interest or participation, which can lead to more stable price movements.

By analyzing trading volume patterns, traders and investors can gain a better understanding of market sentiment and potential price trends. For example, a significant increase in trading volume accompanied by a sharp price increase could indicate a bullish trend, while a decrease in volume during a price rally may signal a potential reversal.

Identifying common trading volume patterns in cryptocurrency trading

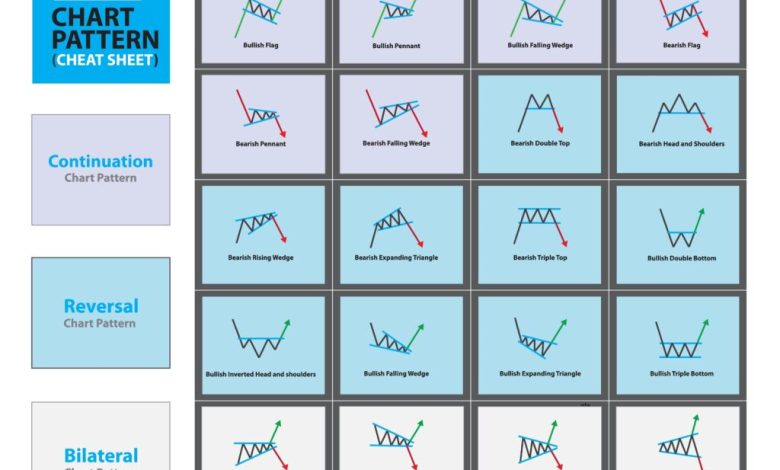

When it comes to identifying common trading volume patterns in cryptocurrency trading, there are several key indicators that traders can look out for. By analyzing these patterns, traders can gain valuable insights into market trends and make more informed trading decisions.

One common trading volume pattern to watch for is a spike in trading volume. This can indicate increased interest in a particular cryptocurrency, potentially signaling a price movement in the near future. Traders often use spikes in trading volume as a signal to enter or exit a trade.

On the other hand, a decrease in trading volume can also be a significant indicator. A sudden drop in trading volume may suggest that interest in a cryptocurrency is waning, which could lead to a price decline. Traders should be cautious when trading cryptocurrencies with low trading volume.

Another important pattern to consider is consolidation in trading volume. When trading volume remains relatively stable over a period of time, it may indicate that the market is in a state of consolidation. Traders can use this information to anticipate potential breakouts or breakdowns in price.

Overall, by analyzing trading volume patterns in cryptocurrency markets, traders can gain a better understanding of market dynamics and improve their trading strategies. It is essential to pay attention to these patterns and use them in conjunction with other technical analysis tools to make well-informed trading decisions.

Exploring the impact of trading volume on market liquidity

Exploring the impact of trading volume on market liquidity is crucial for understanding the dynamics of crypto markets. Trading volume refers to the total number of assets traded within a specific period, typically 24 hours in the cryptocurrency space. Market liquidity, on the other hand, represents the ease with which assets can be bought or sold without significantly affecting their price.

High trading volume often indicates increased market activity and interest in a particular asset. This can lead to higher liquidity levels as there are more buyers and sellers in the market. On the contrary, low trading volume may result in decreased liquidity, making it harder to execute trades without impacting the asset’s price.

By analyzing trading volume patterns in crypto markets, traders and investors can gain valuable insights into market sentiment and potential price movements. Understanding how trading volume impacts liquidity can help market participants make more informed decisions and manage their risk exposure effectively.

Strategies for interpreting and utilizing trading volume data effectively

When it comes to interpreting and utilizing trading volume data effectively in crypto markets, there are several strategies that can be employed to make informed decisions. By understanding the patterns and trends in trading volume, traders can gain valuable insights into market sentiment and potential price movements.

- One strategy is to look for spikes in trading volume, as these can indicate increased interest and activity in a particular cryptocurrency. High trading volume often precedes significant price movements, so keeping an eye on volume spikes can help traders anticipate market changes.

- Another approach is to compare trading volume across different time frames. By analyzing volume data on daily, weekly, and monthly charts, traders can identify trends and patterns that may not be immediately apparent on shorter time frames.

- Additionally, traders can use trading volume data in conjunction with other technical indicators, such as moving averages or relative strength index (RSI), to confirm signals and make more informed trading decisions.

- It is also essential to consider the context in which trading volume data is occurring. For example, a sudden increase in volume during a period of low volatility may indicate a potential breakout, while high volume during a downtrend could signal capitulation.

Overall, by incorporating trading volume data into their analysis, traders can gain a deeper understanding of market dynamics and improve their chances of success in the highly volatile world of crypto trading.

Case studies of successful trading based on volume patterns in crypto markets

Several case studies have demonstrated the effectiveness of utilizing volume patterns in crypto markets for successful trading strategies. By analyzing the trading volume of various cryptocurrencies, traders can gain valuable insights into market sentiment and potential price movements.

One notable example is the analysis of Bitcoin’s trading volume during periods of price consolidation. Traders who observed a significant increase in trading volume following a period of low volatility were able to anticipate a breakout and capitalize on the subsequent price movement.

Another case study focused on the correlation between trading volume and price trends in altcoins. By identifying patterns where a surge in trading volume preceded a sharp increase in price, traders were able to enter positions early and ride the momentum for profitable trades.

Additionally, analyzing volume patterns in conjunction with other technical indicators such as moving averages and RSI can provide further confirmation for trading decisions. By incorporating volume analysis into their trading strategies, traders can enhance their overall performance and increase their chances of success in the highly volatile crypto markets.